| | | | | Chair | | | | | | Member | | *

| * | | | Lead Director |

Member

†

| | | † | | | Audit Committee Financial Expert | |

Experience, Expertise and Diversity | | | | | Leadership

8 director nominees | | | | | | Mergers & Acquisitions

58 director nominees

| | | | | | Current/Former CEO

56 director nominees

| | | | | | | Financial Matters

78 director nominees

| | | | | | Diversity

50% of non-employeeindependent director nominees are racially or gender diverse | | | | | | Corporate Governance

4 director nominees | | | | | | | Operational

8 director nominees | | | | | | International Experience

8 director nominees | | | | | | Independence

6 director nominees | | | | | | | Industry

3 director nominees | | | | | | Risk Management

8 director nominees | | | | | | Average Tenure of Non-EmployeeIndependent Director Nominees

Approximately 67 years | |

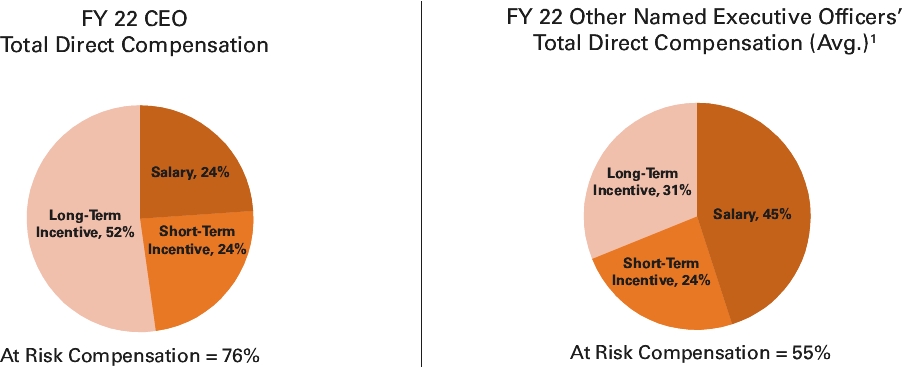

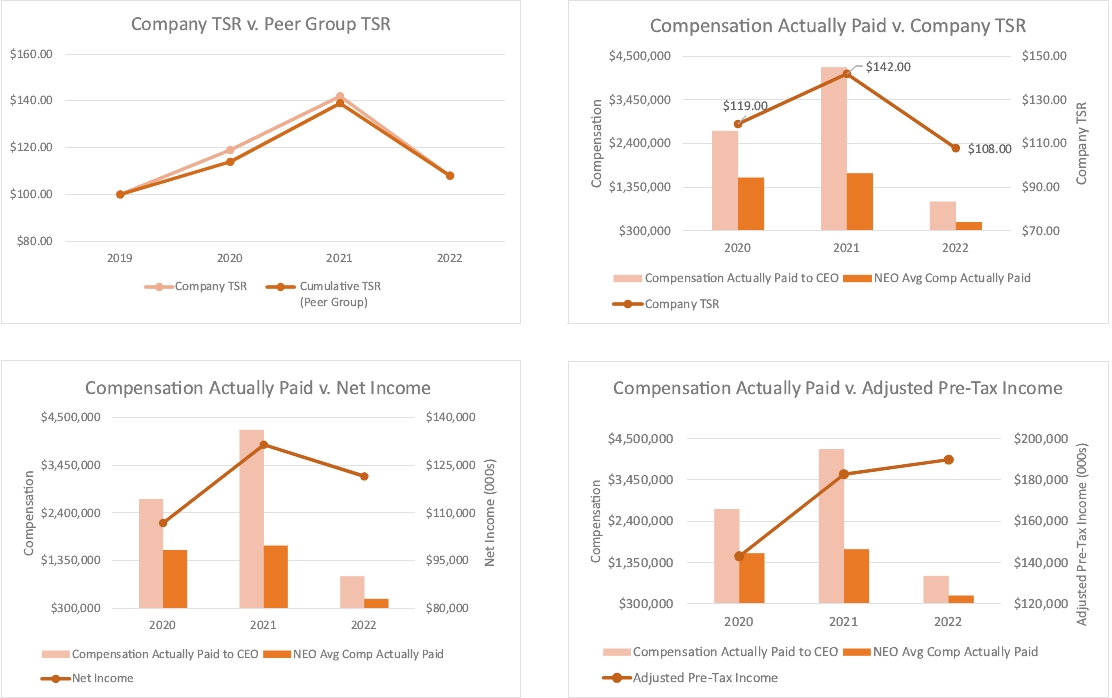

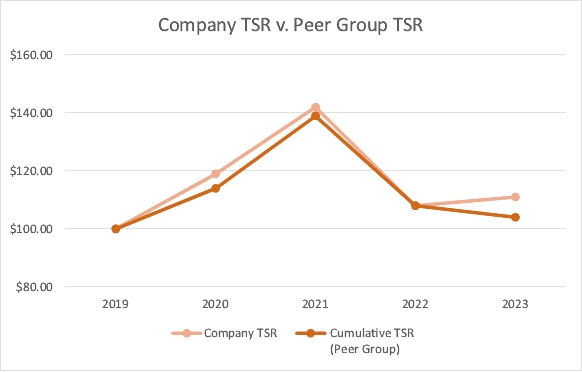

2 |  20232024 Proxy StatementTABLE OF CONTENTS Proposal II: Advisory Approval of the Compensation of our Named Executive Officers Our executive compensation program is designed to promote the successful implementation of our annual strategic plan as approved by the Board as well as long-term growth and profitability of the Company, which is intended to enhance shareholder value. Below is information to support the Board’s recommendation that shareholders approve on an advisory basis the compensation of the Company’s named executive officers for 2022.2023. Executive Compensation Highlights Our executive compensation program is designed to help ensure that pay is aligned with our business objectives and the interests of our shareholders. Below are some of the key highlights of our executive compensation program. | | ☑✔

| | | A majority of fiscal 20222023 target compensation for named executive officers was variable and performance-based | | | ☑✔

| | | Robust stock ownership guidelines for executive officers | | | | ☑✔

| | | Grants of performance-based restricted stock units that vest based on total shareholder return as compared to companies comprising the S&P Mid-Cap 400 Growth Index | | | ☑✔

| | | Clawback policypolicies for executive officers covering both cash and equity incentive compensation | | | | ☑✔

| | | Mix of diversified short- and long-term performance metrics to incentivize and reward the achievement of strategic objectives | | | ☑✔

| | | No tax gross-up provided under our Executive Severance Plan | | | | ☑✔

| | | Caps on annual and certain long-term incentive programs | | | ☑✔

| | | No excessive perquisites for any of our executive officers | | | | ☑✔

| | | Anti-hedging and anti-pledging policies applicable to executive officers and directors | | | | | | | |

20222023 Financial and Operational Highlights

| | ■ | | | Net sales increased 29% to $1,929.8 million in fiscal 2023 from $1,733.7 million in fiscal 2022 from $1,345.2 million in fiscal 2021 | | | ■ | | | Opened a new distribution centerRepaid $159.1 million of indebtedness in Whiteland, Indiana and invested in technology to automate certain of our other distribution facilitiesfiscal 2023

| | | | ■ | | | Generated cash flows from operations of $42.2$208.8 million in fiscal 20222023 | | | ■ | | | Acquired SuperATV, acceleratingReorganized management and reporting under three reporting segments – Light Duty, Heavy Duty and Specialty Vehicle – enhancing transparency and supporting the Company’s specialty vehiclecontinued growth strategyof the Company

| | | | ■ | | | Diluted earnings per share of $3.85 for the twelve months ended December 31, 2022,$4.10 in fiscal 2023, a 7.0% decrease6% increase over the prior year | | | ■ | | | Successfully integrated the Dayton PartsSuperATV business, expanding uponaccelerating the Company’s commitment to the heavy-duty sectorspecialty vehicle growth strategy | |

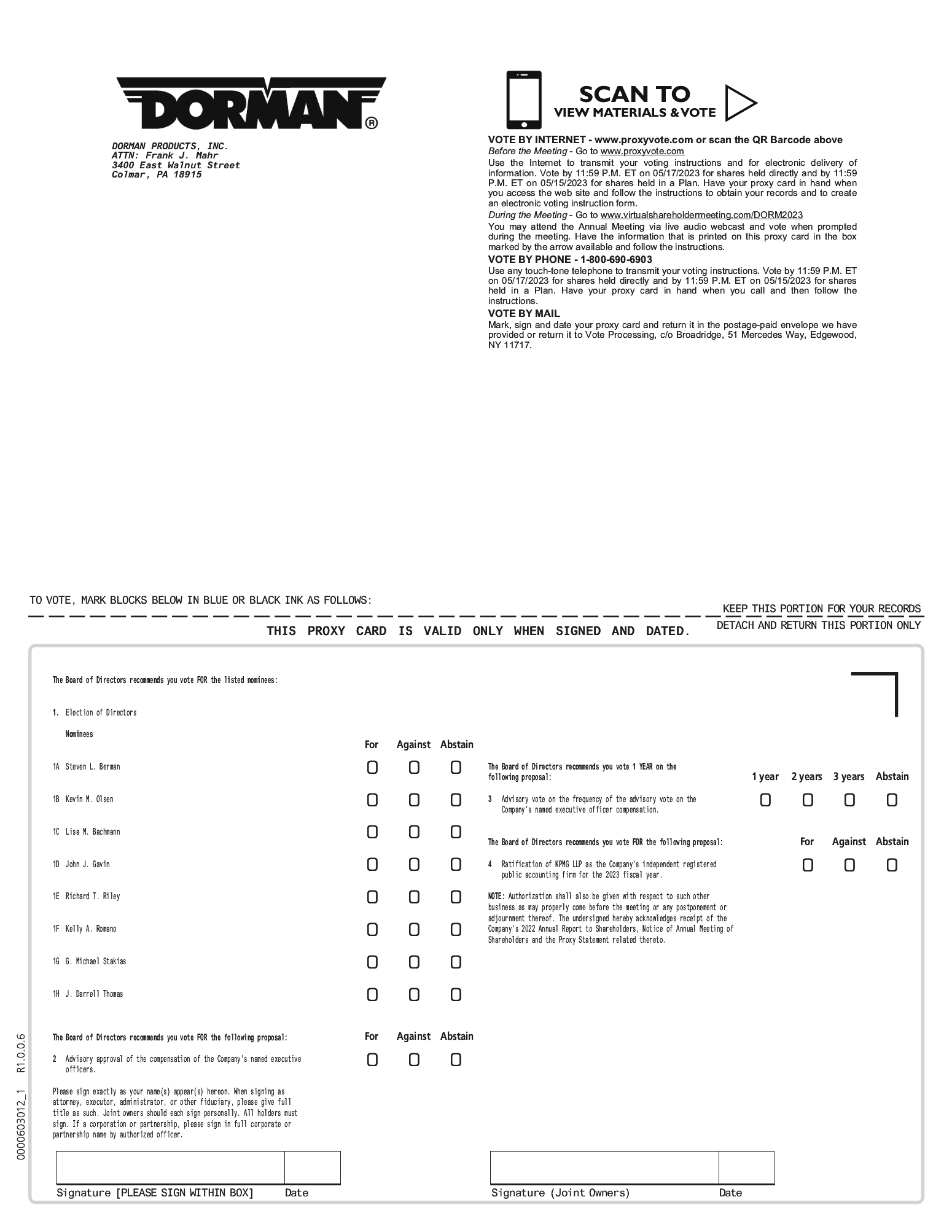

For additional information, see “Executive Compensation: Compensation Discussion and Analysis.” Proposal III: Advisory Approval of the Frequency of the Advisory Vote on Named Executive Officer Compensation We are required to hold an advisory vote regarding the frequency of “say-on-pay” votes every six years. Our shareholders were most recently provided with the opportunity to vote on the frequency of “say-on-pay” votes in 2017. At that time, shareholders voted in favor of holding “say-on-pay” votes every year, and the Board adopted this standard.

The Board believes that an annual shareholder vote on the compensation paid to the Company’s named executive officers provides the Board with current information on shareholder sentiment about our executive compensation program and enables the Board to respond timely, when deemed appropriate, to shareholder concerns about that program. Accordingly, the Board recommends a vote of “one year” as the frequency with which shareholders are provided an advisory vote on the compensation of our named executive officers.

Proposal IV: Ratification of KMPG as our Independent Registered Public Accounting Firm for Fiscal 20232024

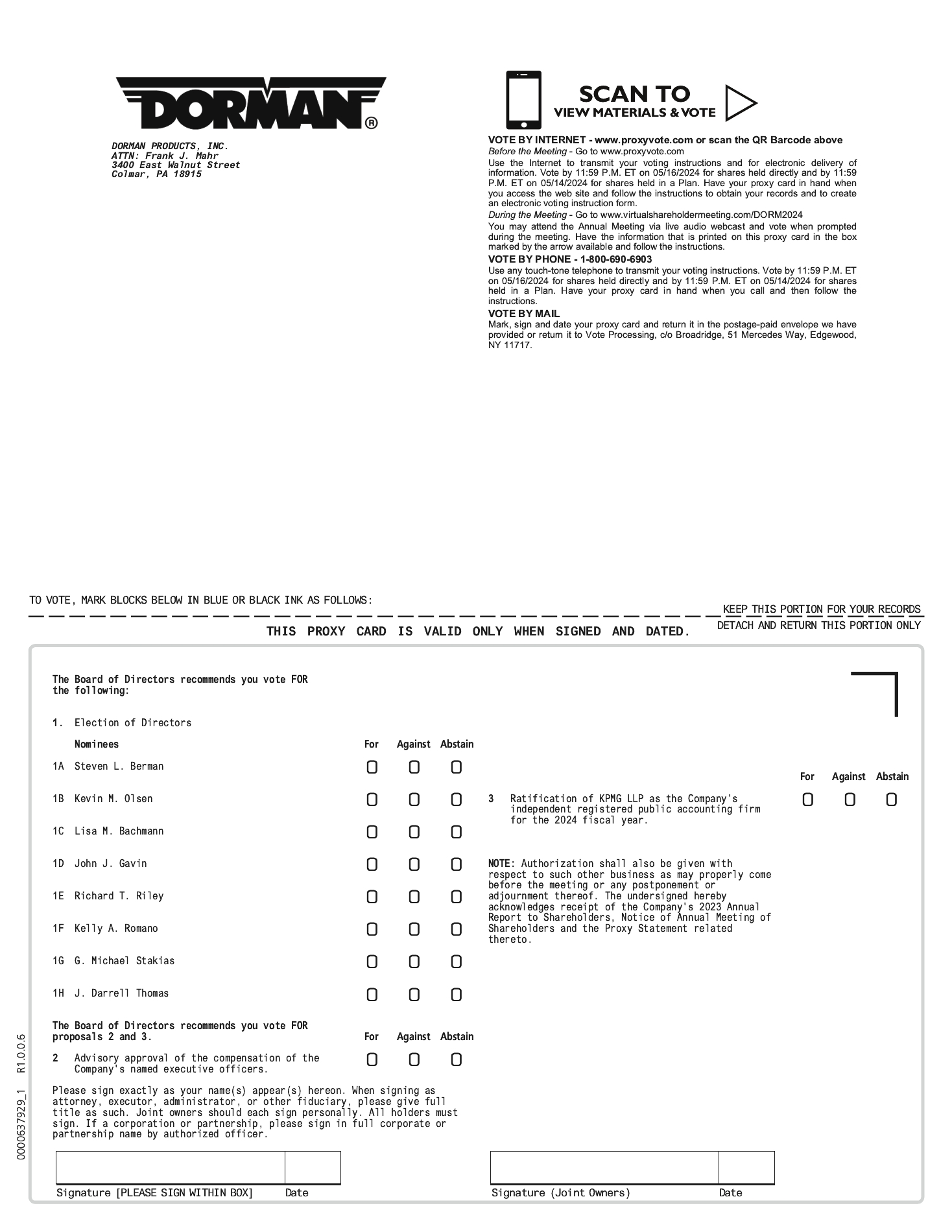

KPMG was our independent registered public accounting firm for the fiscal year ended December 31, 2022.2023. The Board recommends that shareholders ratify, on an advisory basis, the appointment of KPMG as our independent registered public accounting firm for the fiscal year ending December 31, 2023.2024.  20232024 Proxy Statement | 3TABLE OF CONTENTS PROPOSAL I: ELECTION OF DIRECTORS Our Amended and Restated By-laws currently provide that our business shall be managed by or under the direction of a board of directors of not less than two nor more than nine directors, which number shall be fixed from time to time by such board of directors. The Board currently consists of eight directors. There are eight nominees for election to the Board at the annual meeting. Each of the eight nominees, if elected, will hold office for a term that expires at the next annual shareholders’ meeting. Each director shall hold office for the term for which he or she was elected and until his or her successor is elected and qualified or until his or her earlier death, resignation or removal. Proxies solicited by the Board will, unless otherwise directed, be voted to elect the eight nominees named below to constitute the entire Board. The Board has nominated each of the following individuals for election as a director at the annual meeting: Steven L. Berman, Kevin M. Olsen, Lisa M. Bachmann, John J. Gavin, Richard T. Riley, Kelly A. Romano, G. Michael Stakias and J. Darrell Thomas. Each nomination for director was based upon the recommendation of our Corporate Governance and Nominating Committee and each nominee for director is a current member of the Board. The following table sets forth the name, age, position and tenure, as of the date of this proxy statement, as to each nominee for the office of director: | | Steven L. Berman | | | 64 | | | Non-Executive Chairman | | | 1978 | | | | Kevin M. Olsen | | | 52 | | | Chief Executive Officer, President and Director | | | 2019 | | | | Lisa M. Bachmann | | | 62 | | | Director | | | 2020 | | | | John J. Gavin | | | 67 | | | Director | | | 2016 | | | | Richard T. Riley | | | 68 | | | Director | | | 2010 | | | | Kelly A. Romano | | | 62 | | | Director | | | 2017 | | | | G. Michael Stakias | | | 74 | | | Director | | | 2015 | | | | J. Darrell Thomas | | | 63 | | | Director | | | 2021 | |

4 |  2024 Proxy Statement 2024 Proxy Statement

TABLE OF CONTENTS PROPOSAL I: ELECTION OF DIRECTORS

The nominations were based, in part, on the nominees’ various experience, skills and qualifications, some of which are highlighted in the table below. The Board believes these attributes help enable the Board to provide insightful leadership and oversight. | | | | | Leadership | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | | | | | Financial | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | | | | | Operational | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | | | | | Industry | | | ✔ | | | ✔ | | | | | | | | | ✔ | | | | | | | | | | | | | | | | Mergers & Acquisitions | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | | | | | Diversity | | | | | | | | | ✔ | | | | | | | | | ✔ | | | | | | ✔ | | | | | | | International Experience | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | | | | | Risk Management | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | | | | | Current/former CEO | | | ✔ | | | ✔ | | | | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | | | | | | | | Corporate Governance | | | | | | | | | | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | | | | | | | | Independence | | | | | | | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | |

All nominees have consented to be named and have indicated their intent to serve if elected. In the event any of the nominees shall be unable or unwilling to serve as a director, the persons named in the proxy intend to vote “FOR” the election of any person as may be nominated by the Board in substitution. The Company has no reason to believe that any of the nominees named below will be unable to serve as a director if elected. The following table sets forth certain information, as of the date of this proxy statement, as to each nominee for the office of director:

| | Steven L. Berman | | | 63 | | | Non-Executive Chairman | | | 1978 | | | | Kevin M. Olsen | | | 51 | | | Chief Executive Officer, President and Director | | | 2019 | | | | Lisa M. Bachmann | | | 61 | | | Director | | | 2020 | | | | John J. Gavin | | | 66 | | | Director | | | 2016 | | | | Richard T. Riley | | | 66 | | | Director | | | 2010 | | | | Kelly A. Romano | | | 61 | | | Director | | | 2017 | | | | G. Michael Stakias | | | 73 | | | Director | | | 2015 | | | | J. Darrell Thomas | | | 62 | | | Director | | | 2021 | |

4 2024 Proxy Statement | 2024 Proxy Statement |  2023 Proxy Statement5TABLE OF CONTENTS PROPOSAL I: ELECTION OF DIRECTORS

The following information about our directors is based, in part, upon information supplied by them. Unless otherwise indicated, each individual has had the same principal occupation for more than five years.

| | | Steven L. Berman, age 6364

Director Since: 1978

| Steven L. Berman became the Non-Executive Chairman of the Company effective April 1, 2023, having served as its Executive Chairman since September 2015. Additionally, Mr. Berman has served as a director of the Company since its inception in 1978. From January 2011 to September 2015, Mr. Berman served as Chairman of the Board and Chief Executive Officer of the Company and from October 2007 to January 2011, Mr. Berman served as President of the Company. Prior to October 2007, Mr. Berman served as Executive Vice President of the Company. | Key Attributes, Experience and Skills: Mr. Berman has more than 40 years of experience in the automotive aftermarket industry and has been involved with the Company since its formation, including over 40 years in management of the Company. He has the requisite skills to serve in his executive capacitiesas a director of the Company, including particular skills and knowledge in marketing, finance, product development, vendor relations and strategic business management. Mr. Berman maintains strong relationships with the Company’s customers and has the ability to connect industry trends, market events, strengths and weaknesses of competitors, the impact of new market entrants and the ability to define a strategic path. In addition, he has demonstrated the ability to convert a high-level strategy into an executable operating plan. As a result of his prior positions with the Company, he alsoMr. Berman has substantial industry knowledge and intimate knowledge of the Company’s business, results of operations and financial condition, which enables him to provide unique insights into the Company’s challenges, opportunities, risks and operations. |

| | | Kevin M. Olsen, age 5152

Chief Executive Officer, President and Director

Director Since:January 2019 | | | Public Company Board

Service in Past 5 Years: | | |

Twin Disc, Inc., 2022-present | Mr. Olsen joined the Company in July 2016 as Senior Vice President and Chief Financial Officer. He became Executive Vice President, Chief Financial Officer in June 2017, President and Chief Operating Officer in August 2018 and President and Chief Executive Officer in January 2019. Prior to joining the Company, Mr. Olsen was Chief Financial Officer of Colfax Fluid Handling, a division of Colfax Corporation, a diversified global manufacturing and engineering company that provides gas and fluid-handling and fabrication technology products and services to commercial and governmental customers around the world, from January 2013 through June 2016. Prior to joining Colfax, he served in progressively responsible management roles at the Forged Products Aero Turbine Division of Precision Castparts Corp.,Corp, Crane Energy Flow Solutions, a division of Crane Co., Netshape Technologies, Inc., and Danaher Corporation. Prior thereto, Mr. Olsen performed public accounting work at PricewaterhouseCoopers LLP. | Key Attributes, Experience and Skills: Mr. Olsen has the ability to provide unique insights as the Company’s current Chief Executive Officer. In addition, he brings to the Board substantial experience in executive leadership and financial management with large organizations, which he gained principally from his service as Chief Executive Officer of Dorman, a role he has held since January 2019, and his prior service as Chief Financial Officer at Dorman and Colfax and his public accounting experience at PricewaterhouseCoopers LLP. |

2023 Proxy Statement6 |  52024 Proxy StatementTABLE OF CONTENTS PROPOSAL I: ELECTION OF DIRECTORS

| | | Lisa M. Bachmann, age 6162

Director Since: September 2020

Committees: Audit; Compensation; Corporate Governance and Nominating | | | Public Company Board

Service in Past 5 Years: | | |

GMS Inc., 2020-present | Ms. Bachmann most recently served as Executive Vice President, Chief Merchandising and Operating Officer of Big Lots, Inc. (NYSE:BIG) (“Big Lots”), a publicly traded leading discount retailer, from August 2015 to September 2020. Previously, she held various roles at Big Lots, including as Executive Vice President, Chief Operating Officer, as Executive Vice President, Supply Chain Management and Chief Information Officer, and as Senior Vice President, Merchandise Planning, Allocation and Presentation. Prior to joining Big Lots in March 2002, her roles included Senior Vice President of Planning and Allocation for Ames Department Stores Inc. and Vice President of Planning and Allocation for the Casual Corner Group, Inc. | Key Attributes, Experience and Skills: Ms. Bachmann’s qualifications to serve as a director of the Company include her extensive executive leadership experience and business acumen. Her years of experience at Big Lots and several other established retailers provide her with considerable expertise in the areas of management, operations, finance, sales, marketing, distribution, technology, business development and strategy. In addition, Ms. Bachmann has obtained a CERT Certificate in Cyber-Risk Oversight issued by the CERT Division of the Software Engineering Institute at Carnegie Mellon University. |

| | | John J. Gavin, age 6667

Director Since: October 2016

Committees: Audit; Compensation (Chair); Corporate Governance and Nominating | | | Public Company Board

Service in Past 5 Years: | | |

GMS Inc., 2014-present

| Mr. Gavin was most recently appointed Chairman of GMS Inc. in 2019. Previously, he was a Senior Advisor with LLR Partners, LLC, a middle market, growth oriented private equity firm, from 2010 to 2017, and had been Chairman of Strategic Distribution, Inc. (“SDI”), a leading maintenance, repair, and operations (MRO) supply firm from 2014 to 2017. Prior to holding his Chairman position at SDI, Mr. Gavin served as Chief Executive Officer and President of SDI. Mr. Gavin previously held positions with Drake Beam Morin, Inc., an international career management and transitions management firm, Right Management Consultants, Inc., a publicly traded global provider of integrated consulting solutions across the employment lifecycle, and Arthur Andersen & Co. Mr. Gavin currently serves on the Advisory Board of the Center for Corporate Governance at Drexel University in Philadelphia and on the boards of various privately held companies. | Key Attributes, Experience and Skills: Mr. Gavin is qualified to serve as a director of the Company because of his expertise with financial, accounting, strategic planning, mergers and acquisitions, human resources and career management matters, his extensive management and operational experience, his current and prior service on the board of directors of other publicly and privately held companies and his financial and accounting experience, including his experience as a certified public accountant with a nationally recognized public accounting firm. |

6 2024 Proxy Statement | 2024 Proxy Statement |  2023 Proxy Statement7TABLE OF CONTENTS PROPOSAL I: ELECTION OF DIRECTORS

| | | Richard T. Riley, age 6668

Director Since: March 2010

Committees: Audit (Chair); Compensation; Corporate Governance and Nominating | | | Lead Director

| | | | | | Public Company Board Service in Past 5 Years: | | |

Tupperware Brands Corporation, 2015-present

Cimpress N.V. (f/k/a VistaPrint N.V.), 2005-2018

| Prior to his retirement from LoJack Corporation, then a public company listed on NASDAQ and a global provider of tracking and recovery systems (“LoJack”), Mr. Riley served in various capacities as Executive Chairman, Chairman, President, Chief Operating Officer and Director from 2005 to 2013. Prior to joining LoJack, Mr. Riley most recently served as Chief Executive Officer, President, Chief Operating Officer and a Director of New England Business Service, Inc. (“NEBS”), then a public company listed on the New York Stock Exchange and a provider of products and services to assist small businesses manage and improve the efficiency of business operations. From February 2005 through December 2018, Mr. Riley also served as a Board member and Chairman of the Supervisory Board of Cimpress, N.V. (f/k/a VistaPrint, N.V.), then a publicly traded Dutch company listed on NASDAQ that invests in and builds customer focused, entrepreneurial, mass customization businesses. From 2000 to the sale of the Companycompany in June 2016, Mr. Riley served on the Board, most recently as Vice Chair and significant shareholder (approximately 33%) of Micro-Coax, Inc., a privately held company that manufactured micro coaxial cable, primarily for the defense and space industries. Mr. Riley was formerly a Manager in the audit practice at Arthur Andersen & Co. He also serves as a member of the Board of Trustees at Thomas Jefferson University Hospital and as a member of the Advisory Board of the University of Notre Dame. | Key Attributes, Experience and Skills: Mr. Riley is an experienced leader in the automotive industry with a distinctive knowledge of the automotive products aftermarket. He draws his financial expertise from his experience at Arthur Andersen & Co., his service as an executive at each of LoJack and NEBS, and his service on the audit committees of other public companies. He is skilled in finance, operations, corporate governance, mergers and acquisitions and strategic planning. Mr. Riley’s financial background as a certified public accountant, including his experience at Arthur Andersen & Co., provides financial expertise to the Board, including an understanding of financial statements, corporate finance, accounting and capital markets. |

| | | Kelly A. Romano, age 6162

Director Since: November 2017

Committees: Audit; Compensation; Corporate Governance and Nominating

| | | Public Company Board Service in Past 5 Years: | | | UGI Corporation, 2019-present

Athira Pharma, Inc., 2020-present | Ms. Romano is the Chief Executive Officer of BlueRipple Capital, LLC, a consultancy firm she founded in May 2018 that is focused on strategy, acquisitions, deal structure, and channel development for high technologyhigh-technology companies. In addition, she has been an executive advisory board member of Gryphon Investors (“Gryphon”), a private equity firm focused on middle-market investment opportunities, since December 2016, and iswas Co-Chair of the Board of Potter Electric, one of Gryphon’s portfolio companies in the fire life safety industry.industry until November 2023, when it was acquired by KKR & Co. Inc. Ms. Romano also servesserved as an operating partner for AE Industrial Partners, LLC, a private equity firm focused in the aerospace and industrial sectors sincefrom August 2020.2020 to August 2023. As an operating partner, she servesserved on several of its portfolio company boards. She remains the Chair of the Board of Altus Fire & Life Safety, a role she has held since May 2021. From 1984 to April 2016, Ms. Romano served in various capacities at United Technologies Corporation (“UTC”), a New York Stock Exchange listed company that provided high technologyhigh-technology products and services to the building and aerospace industries, which merged with Raytheon Corporation in 2020. From September 2014 to April 2016, Ms. Romano served as President, Intelligent Building Technologies for the UTC Building & Industrial Systems business. Previously, she held other executive level positions within UTC including President, Global Security Products, President, Building Systems and Services and President, Distribution Americas. | Key Attributes, Experience and Skills: Ms. Romano has extensive executive leadership experience and business acumen. Ms. Romano’s broad experience in the private equity market and at UTC provides her with a wide-ranging perspective in the areas of management, manufacturing, operations, finance, sales, marketing, distribution, research and development, mergers and acquisitions, business development and strategy. |

2023 Proxy Statement8 |  72024 Proxy StatementTABLE OF CONTENTS PROPOSAL I: ELECTION OF DIRECTORS

| | | G. Michael Stakias, age 7374

Director Since: September 2015

Committees: Audit; Compensation; Corporate Governance and Nominating (Chair) | Mr. Stakias has served as President and Chief Executive Officer of Liberty Partners, a New York-based private equity investment firm, since 2008, after serving there as a partner since he joined the firm in 1998. From 1980 to 1998, Mr. Stakias was a partner at Blank Rome LLP, Philadelphia, PA. His practice focused on the areas of corporate securities, mergers and acquisitions, private equity, and public and emerging growth companies. Prior to joining Blank Rome, Mr. Stakias served as Senior Attorney, Division of Corporation Finance, at the Securities and Exchange Commission, Washington, DC. Mr. Stakias serves on the Board of Trustees of the College of William & Mary - Raymond A. Mason School of Business in Williamsburg, VA. | Key Attributes, Experience and Skills: Mr. Stakias’ qualifications to serve as a director of the Company include his extensive experience in private equity investment and capital markets, his legal background and his expertise in corporate securities, mergers and acquisitions and corporate finance. Mr. Stakias’ experience in private equity provides him with considerable expertise in financial and strategic matters and his involvement with other entities throughout his career provides him with wide-ranging perspective and experience in the areas of management, operations, and strategy. |

| | | J. Darrell Thomas, age 6263

Director Since: October 2021

Committees: Audit; Compensation; Corporate Governance and Nominating

| | | Public Company Board Service in Past 5 Years: | | | British American Tobacco p.l.c., 2020-present

Pitney Bowes Inc., 2023-present | Mr. Thomas most recently served as Vice President and Treasurer for Harley-Davidson, Inc. (NYSE:HOG), a publicly traded company (“Harley-Davidson”), a position which he held from June 2010 to April 2022. Since joining Harley-Davidson in June 2010, he also served in several senior finance positions, including Interim Chief Financial Officer for Harley-Davidson from July 2020 to September 2020 and Chief Financial Officer for Harley-Davidson Financial Services, Inc. from January 2018 to June 2020. Prior to joining Harley-Davidson, Mr. Thomas was employed by PepsiCo, Inc. (NASDAQ:PEP), a publicly traded company (“PepsiCo”), which he joined in December 2003, and where he most recently served as Vice President and Assistant Treasurer. Prior to joining PepsiCo, Mr. Thomas had a 19-year career in banking with Commerzbank Securities, Swiss Re New Markets, ABN Amro Bank and Citicorp/Citibank where he held various capital markets and corporate finance roles. Mr. Thomas serves as a non-executive director of Scotia Holdings (US) Inc. | Key Attributes, Experience and Skills: Mr. Thomas is qualified to serve as a director of the Company because of his experience with corporate finance, capital markets, risk management and investor relations, his extensive management and operational experience, his service on the boards of directors of other publicly held companies and his financial and accounting experience. |

| | FOR

| | | THE BOARD RECOMMENDS A VOTE “FOR” THE ELECTION OF THE EIGHT NOMINEES LISTED ABOVE AS DIRECTORS. | |

8 2024 Proxy Statement | 2024 Proxy Statement |  2023 Proxy Statement9 | | | † | | | Audit Committee Financial Expert | |